What You Should Know about the Bitcoin Revolution

What would you do if you feared that your bank was going to confiscate the bulk of your savings? You'd remove your funds from that bank, wouldn't you? That's what's happening all over Europe (and in other parts of the world), triggered by the “haircut”that customers of Cypriot banks received on March 29th, 2013. According to an article in the British Daily Mail:

- Nobody can remove more than 300 Euros a day from their account.

- Nobody can take more than €1,000 off the island in cash.

- 80% of deposits over €85K is gone! 37.5% of it has been converted into probably worthless shares of the bank's stock. And 40% will be repaid to you only if the bank “does well”in the future, while 22.5% will go into a contingency fund that could be subject to further write-offs.

Here’s one example from a British ex-pat, living in Cyprus, who didn’t move fast enough to remove his funds:

“Neil Hodgson, 48, who moved to Paphos, on the southwest coast of the island, six years ago, said he has lost nearly £200,000. The former farmer, who has two accounts with the Bank of Cyprus added:

‘I had more than £300,000 in my deposit account and £20,000 in my current account. When I went to the bank the other day I was told the total balance for both is £100,000.’

They were unable to explain how this had been worked out, but indicated I might get some back at a later stage. I checked online and confirmed that the 20,000 in my current account remains, but that I only have £80,000 in my savings account. It's robbery, plain and simple.’”

~ Quoted by Dan Atkinson and Ian Gallagher in

‘It’s Robbery!’ New Cyprus bombshell as Britons are told they may lose EVERYTHING over £85k

Surprising (?) Rise of a Non-Banking Payment Ecosystem: BitCoin

Surprising (?) Rise of a Non-Banking Payment Ecosystem: BitCoin

Even before the banking bailout in Cypress (why are they going after customers and not shareholders and bond holders?), our private Pioneers’ discussion list had been buzzing with postings about Bitcoin since October, 2011. At first, it seemed like an interesting “techie” phenomenon—an anonymous secure way to transfer and exchange digital currency (which can be converted into national currencies) in a peer-to-peer network that is distributed, does not use banks, is unregulated and not easily monitorable by government agencies. Perfect for laundering drug money, engaging in drug or gun trafficking, or just hedging your bets against bank runs and/or massive inflation that devalues your local currency.

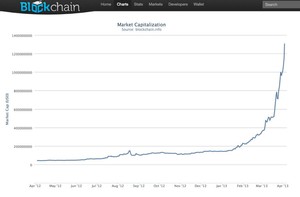

However, Bitcoin is a confusing, highly technical, and not very user-friendly alternative to the current financial system. It is also highly volatile. So the chances of its becoming mainstream seemed pretty slim. But notice what has been going on. The total value of the currency being traded in Bitcoins has now surpassed $1 billion.

As this tidbit from Slashdot explains, Bitcoin currency now surpasses 20 national currencies in total value:

“More than $1 billion worth of bitcoins now circulate on the web –an amount that exceeds the value of the entire currency stock of small countries like Liberia, Bhutan, and 18 other countries. Bitcoin is in high demand right now — each bitcoin currently sells for more than $90 U.S. — which bitcoin insiders say is because of world events that have shaken confidence in government-issued currencies. ‘Because of what's going on in Cyprus and Europe, people are trying to pull their money out of banks there,’said Tony Gallippi, the CEO BitPay.com, which enables businesses to easily accept bitcoins as payment. ‘So they buy gold, they put it under the mattress, or they buy bitcoin,’Gallippi said.”

If you are new to the Bitcoin discussion and want to catch up, I recommend two excellent articles by Nicolás Mendoza: Understanding Bitcoin and Bitcoin Rises.

Here’s an excerpt from Understanding Bitcoin, but I recommend that you read both articles—Mendoza’s social commentary is really interesting:

“In 2008, a programmer known as Satoshi Nakamoto coded a critique of the world's monetary system into a P2P computer protocol he called Bitcoin. Bitcoin started running on January 3, 2009, and is now a working decentralised monetary system with thousands of users around the world.

The Bitcoin protocol is based on a fundamental critique of the world's monetary system: that it demands undeserved amounts of trust from us. Nakamoto thought that it would be better to place trust outside the monetary system itself and back into social life:

‘The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.’

Through a clever use of encryption technology, the Bitcoin protocol enables this move. In networked storage systems, Nakamoto explains, strong encryption technology affords end users peace of mind because they no longer need to trust the system admin with their privacy. He argues that if money could be similarly encrypted, middlemen who provide trust (e.g. banks) could be bypassed:

‘It's time we had the same thing [strong encryption] for money. With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless. (…)

[Bitcoin] takes advantage of the nature of information being easy to spread but hard to stifle. The result is a distributed system with no single point of failure. Users hold the crypto keys to their own money and transact directly with each other, with the help of the P2P network to check for double spending.’The result is Bitcoin. It is not controlled by any state nor owned by any company; neither is it a company in itself. It is merely an open source computer protocol that runs over the internet.”

~ Nicolás Mendoza: Understanding Bitcoin

Number of Players and Layers in the Bitcoin Ecosystem Is Increasing

As the number of people creating Bitcoins and exchanging Bitcoins and buying and selling things with Bitcoins increases, the ecosystem grows. There are also additional layers of ecosystem players that are growing as well. Here are just a few of them:

- Currency exchange services that enable people to exchange Bitcoin into virtually any national currency

- Online services, such as Reddit, Worpress, Mega who accept Bitcoins in payment

- Legitimate merchants who take Bitcoins in payment

- Bitcoin drug sales (Silk Road and other notorious online drug networks who accept payment for drugs in Bitcoins)

- Bitcoin gambling businesses—gambling businesses whose currency is Bitcoin

- Bitcoin traders and speculators—investors who are hoping to make money by placing bets on the volatile value of Bitcoin currency

- Bitcoin entrepreneurs—business people who are creating new businesses based on serving and growing the Bitcoin economy

- Bitcoin mining businesses—specialized computer centers hosted in places where the cost of electricity is subsidized

- Bitcoin mining software developers

- Bitcoin mining chip designers

- Bitcoin mining chip manufacturers—producing the customized ASICs that are now available to provide the needed processing power

What’s the bottom line? The Bitcoin phenomenon may be a temporary bubble, created by a perfect storm of cyber-hackers meets drug money meets global financial crisis. But it may also be the beginning of something big: a currency controlled by customers; not bankers and central governments.

0 comments

Be the first one to comment.