Evaluating Current Mobile Payment Options

In the U.S., we’re still playing catch up in mobile payments. Elsewhere in the world, mobile payments are much more commonplace. Paying for things using stored value on mobile phones, texting funds to a friend or family member, or debiting your bank account in real time as you board the subway or buy a coffee are common occurrences. Yet, in this country, those actions are still rare.

Judging from the hype in the press about mobile payments, we act as if the fate of the U.S. economy depends on whether and when mobile payments take off. Investors are placing big bets on whether consumers will prefer Apple Pay vs. Google Wallet vs. Softcard vs. Pay with Amazon vs. CurrentC, etc.

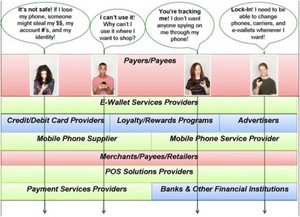

But remember, it’s not just a matter of which mobile e-wallet wins the most marketshare, there are at least six layers of providers in a mobile payment ecosystem. All of the players need to work together seamlessly to provide a secure, friction-free solution for paying at the point of sale with our phones.

How do you figure out which combination of e-payment providers will become the most popular? In our opinion, the best way to do this is to streamline the experience at the customer-critical moments of truth in the mobile payment scenario. Those customer-critical issues are:

- It’s not safe! If I lose my phone, someone might steal my money, my account numbers, and my identity.

- I can’t use it! Why can’t I use it where I want to shop?

- You’re tracking me! I don’t want anyone spying on me.

- Lock-in! I need to be able to change phones, carriers, and e-wallets whenever I want.

Over the next few weeks, we’ll take a look at how the major m-wallet ecosystems deliver on these four moments of truth.

0 comments

Be the first one to comment.