How Do Customers Feel about Corporate Tax Dodging?

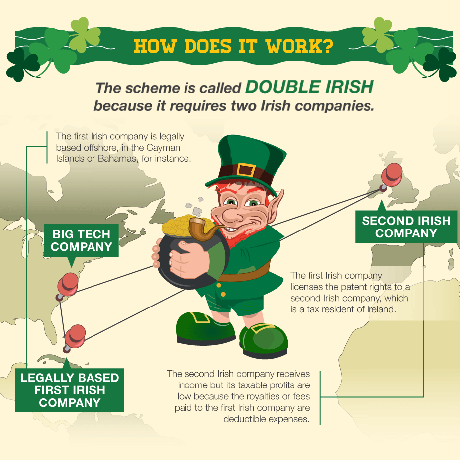

Apple Computer has been accused by the European Union of dodging $14.5 billion in taxes the EU claimes are owed to Ireland. The way this news has been handled by the media is quite damaging to Apple's brand.

Apple is not alone in excelling in dodging corporate income taxes in many countries. The EU claims that Google and Facebook have used the same approach that Apple used to seriously underplay the taxes they owe in Ireland for sales in the EU as well.

But corporate tax dodging is not limited to tech companies. It's been a game mastered by most large corporations. GE, for example, is admired by many for its prowess in minimizing the amount of corporate income taxes it pays around the world.

Ireland has bent over backwards to attract high tech companies by offering tax incentives. And Ireland is sticking with Apple in appealing the EU's ruling.

So why is Apple getting such a bad rap for a practice that is commonplace (not that it should be commonplace)?

Because everyone loves to hate the brand leader and to bring them down. Apple's CEO, Tim Cook claims that Apple and Ireland will prevail in their appeal. He also asserts that Apple's commitment to doing business in Ireland is a strong and lasting commitment, no matter what the outcome of the taxation issue.

So, do customers care? Customers who are already Apple-haters or Apple cynics will use this flap to fan the flames of their distrust of the Apple brand. But frankly, most customers don't care about corporate finances. They care about customer experience. And in that, Apple still excels.

0 comments

Be the first one to comment.