Bitcoin Hacked Again and Again

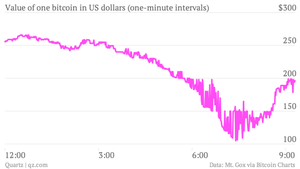

Last week we joined the media frenzy that seemed to suddenly swirl around the odd digital currency known as Bitcoin. That same day, one of the top Bitcoin exchanges, Mt. Gox, suffered a denial of service attack, sending the value of Bitcoins down as investors began panic selling.

Value of one bitcoin in U.S. dollars one-minute intervals chart

Last night, Mt. Gox was out of commission again. Another denial of service attack? Not at first. Mt. Gox posted a different explanation on its Facebook page:

“First of all we would like to reassure you but no, we were not, last night victim of a DDoS but instead the victim of our own success!

Indeed the rather astonishing amount of new accounts opened in the last few days added to the existing ones, plus the number of trades, made a huge impact on the overall system that started to lag. As expected in such a situation people started to panic, started to sell Bitcoin in mass (Panic Sale) resulting in an increase of trade that ultimately froze the trade engine!

To give you an idea of how impressive things were here are some numbers that we would love to share with you guys:

- The number of trades executed tripled in the last 24hrs.

- The number of new accounts opened went from 60k for March alone to 75k new accounts created for the first few days of April!

We now have roughly 20,000 new accounts being created each day.

Due to these facts we have been busy working on improving things since last week and our team has been working around the clock to improve Mt. Gox to catch up with the demand. We will continue to release several updates today and in the coming few days to improve our system’s overall performance.

Also please note that we may have to close the exchange for two hours in the next 12 to 24hrs to add several new servers to our system.

Thank you for your understanding and continuous support!”

No sooner had the Mt. Gox exchange come back online, when it was hit with a Denial of Service attack. There are apparently a lot of computer-savvy Bitcoin miners, holders, and traders who are happy to see the price drop from its high of $250 per Bitcoin to about half that now. So they can create chaos, and then profit from the panic selling, selling high and buying low. And, as Pioneer Peter Horne cautions, "I can only imagine what the drug lords, Chinese hackers, Eastern European money launderers and African scamsters are doing in this rush with unregulated Bitcoin money." So our advice: watch this phenomenon from afar.

0 comments

Be the first one to comment.