Getting the Desired Outcome Right

Citizens Bank Did a Good Job Selling a Prospect, but Couldn’t Meet the Ultimate Goal

The most effective way to sell a prospect is to understand his or her scenario when pitching them. What are they trying to achieve? Do you understand the desired outcome, the priorities, and the emotional concerns they have? If you know all this, you can proactively overcome any objections, and you can sell much more effectively.

NETTING IT OUT

Getting a sales pitch doesn’t have to be unpleasant as long as the pitch is on target with your customer scenario—what you want to get and how you want to get it! A recent impromptu conversation about changing my retail bank went surprising well because the sales person listened to what I cared about and made sure that my concerns were being taken into consideration.

The assistant branch manager at the supermarket branch of Citizens Bank near my home provided a great customer experience and the promise of individual attention in the future. He was able to match the rates and fees that I am receiving from my current bank. However, the sale didn’t happen because my ultimate desired outcome—to make and save more money—couldn’t be offered.

Are you taking into account what your customers want to achieve as well as all their priorities and concerns along the way when you pitch your products and services?

OFFERING CUSTOMERS WHAT THEY REALLY WANT

OFFERING CUSTOMERS WHAT THEY REALLY WANT

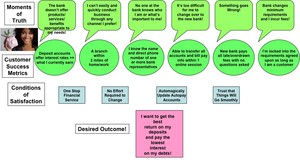

We write a lot about the importance of nailing your customers’ Moments of Truth and the associated metrics when thinking about their scenarios—what they want to accomplish when doing business with you. But we don’t really dive into making sure you really understand their desired outcomes.

The vital importance of correctly articulating the customer’s desired outcome was clearly illuminated for me during a very pleasant customer experience at Citizen’s bank.

A Very Pleasant Sales Pitch

I am not really a Citizen’s bank customer, but I am a co-signer on my elderly aunt’s account. Recently, she discovered that my name is spelled wrong on the account (Ronni Marshal—a relatively common mistake). I put that information in the back of my head to take care of “at some point.”

Grocery shopping the other day, I noted that Citizens Bank had a branch right inside the supermarket, there wasn’t a long line, and I was there anyway, so “at some point” became “now.” I sat down with an assistant manager, Stephen Pane, and explained the situation. Steve immediately solved my problem, apologized for the error, and then, like a good salesperson, he engaged me in conversation. We discussed what I do (and he actually listened to my brief explanation of Customer Scenario Mapping and asked relevant questions). Only then did he ask me if I was happy with my primary bank.

Steve and I talked for a long time about what I liked and didn’t like about my bank, and then he started his pitch, but unlike some unwelcome sales pitches, this was totally based on what I had said. He emphasized the convenience of having branches right where I grocery shopped every week; he assured me Citizens could match all the interest rates I was receiving (both on deposit accounts and my equity line of credit); because I am a “premiere customer” at my bank and, therefore, incur no fees, he promised that I could avoid any fees with just one deposit a month; and he even offered to help me transfer any automatic payments (through online bill pay) and any other “virtual paperwork” that needed to be done. I then found out that he was only helping out at this branch and actually worked several towns over. Still he had the right answer, promising to meet me at my local supermarket whenever I called and then introducing me to Dana Epstein, my local assistant branch manager, who had just returned from break.

No Sale

All in all, Steve, now assisted by Dana, offered me an excellent prospective customer experience along with a very attractive offer. Yet, despite a better experience than I had ever had at my current bank and a good offer matching everything I currently have, I wasn’t sold.

Steve and Dana were very gracious in defeat, even suggesting an online-only savings account with a web-only bank where I could get a higher return on some money I have in a different online bank. (Very good move, guys.) I assured them that if I became dissatisfied with my primary bank and was ready to change, I would call. The very least I could do is let people know what a good job they did listening to a prospect and trying to help her achieve what she wanted.

Priorities on the Way to the Goal Aren’t the Goal itself

In most consumer banking Customer Scenarios there are a handful of Moments of Truth (MoT), three or four activities that are most critical to the customer and represent the “showstoppers”—if the customer can’t easily do these few things, he or she will give up and abandon the scenario. Each MoT (which is always expressed in the negative) is associated with one or more Customer Success Metrics, quantifiable measures that define success or failure of a Moment of Truth. For example, in the Customer Scenario of switching retail banks, moments of truth might include...(more)

(Download the PDF to read the entire article.)

Sign in to download the full article

0 comments

Be the first one to comment.