Zopa: Peer-to-Peer Lender Celebrates 10 Years

Spawned a Global Multibillion Industry; Still Going Strong

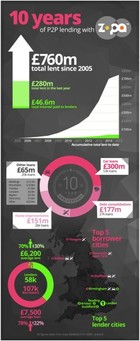

Since 2005, over 50,000 British consumers have invested in providing three- to five-year loans to over 100,000 British consumers and small business owners using Zopa. Lenders have provided £770,000 of their money to their peers, in exchange for an average return of 5 percent. Zopa’s ease of use includes high-touch customer support by phone, email, and chat, and vibrant customer forums, in which company experts mingle with customers to provide tips and address concerns. Zopa provides peace of mind through transparency. Customers and watchdogs can monitor the performance of all loans over time.

NETTING IT OUT

Zopa pioneered the Peer-to-Peer lending industry and has spawned hundreds of competitors, each with a variation on the same model: Consumers lend money directly to other consumers. These P2P exchanges now exist all over the world, accounting for billions of dollars of loans being originated and, in many cases, re-sold as securities.

How has Zopa survived and prospered over its first decade as a new entrant, creating a new business category? And what’s next for this innovative company?

Zopa remains the leader in the U.K. P2P lending industry, it but has not been successful in expanding outside of the U.K. market.

Zopa and its U.K. competitors are hoping for a major regulatory breakthrough that would enable them to participate in the lucrative retirement savings market in the U.K.

Among Zopa’s remarkable accomplishments are its continued intimacy with its customers (both lenders and borrowers) and its incredible transparency about all aspects of its business.

PEER-TO-PEER LENDING PIONEER STILL A MARKET LEADER

Origins

I chronicled the formation of the British Peer-to-Peer (P2P) lending service, Zopa, in the 2006 edition of Outside Innovation1. Zopa was, and still is, a great example of a customer-co-designed business and a business model that challenged (and still does) the banking and credit card industries. Zopa facilitates consumers lending money to one another. Banks are disintermediated. Zopa becomes the new intermediary. Zopa stands for “Zone of Possible Agreement”—the bounds within which two parties can come to an agreement. In the case of money lending and borrowing, the bounds include the amount, the interest rate, and the term of the loan.

The original Zopa case study2 provides a great blueprint for how to do customer research. Zopa was designed with, and by, its target customers, starting in 2004. It launched as a business in 2005 in London.

New Customer Segment. Zopa’s original target customers were dubbed “Freeformers” by its first CEO, Richard Duvall. Freeformers were people who often had trouble getting credit because they didn’t have a 9-to-5 job with a single employer. They didn’t want to work as “salary slaves” for big companies until retirement; they didn’t want to defer enjoyment until retirement. They wanted to spend their time doing things they loved—start their own businesses, travel, spend time with their kids and grandkids. More than 50 percent of them had multiple income streams as well as assets. They were credit-worthy because they were financially responsible, but often didn’t fit the standard credit profile of holding a 40-hour/week job with one employer for the past several years.

They didn’t trust or like traditional financial institutions—banks and credit card companies.

They wanted the money they saved or invested to be used to help others.

They took care of many of their activities online and via mobile phones.

New Business Model. Zopa’s founders, Richard Duvall, Dave Nicholson, James Alexander, Giles Andrews, and their target customer co-designers developed a fairly elaborate business model...(more)

(Download the PDF to read the entire article)

**Endnotes**

[1] Outside Innovation: How Your Customers Will Co-Design Your Company’s Future, by Patricia B. Seybold, published in 2006 by Harper Collins.

[2] How Zopa Is Creating a New Financial Services Exchange: Peer-to-Peer Borrowing and Lending for “Freeformers,” by Patricia B. Seybold, published February 23, 2006, Customers.com Press. See pages 9-20 for customer research and co-design description.

Sign in to download the full article

0 comments

Be the first one to comment.