How Customers Want to Plan for Retirement with Financial Security

Identifying and Measuring the Key Moments of Truth in the “Planning for Retirement” Customer Scenario® Pattern

Customer scenarios fall into patterns. It‘s valuable to know these patterns ahead of time so that you’ll know what kinds of customer and operational metrics to elicit. Then you can focus on how to differentiate the experience, products, and services you offer to help customers reach their goals. This report focuses on the moments of truth and metrics in a typical outcome-based scenario of planning for retirement.

NETTING IT OUT

A very common outcome-based scenario (versus lifecycle-based or event-triggered patterns) is planning for retirement. This report looks at common patterns we’ve found through almost 20 years of customer co-design with financial institutions.

Although each customer has different goals and is in a different situation, there are common moments of truth that everyone trying to save for retirement share. We have identified four key showstoppers that will stop customers in their path to successfully planning for retirement:

- I don't understand what I should be doing and what the right choices are for me

- I have to give up a comfortable lifestyle to save enough

- My retirement plan loses money

- I can’t retire comfortably

We call these the customer’s “Moments of Truth”—aka “showstoppers”—if you don’t address these issues crisply, you risk losing your customer to another financial institution or else your customers will stop being of value to you because they have no money to invest, thus negatively impacting your bottom line and customer portfolio.

Once you recognize the common moments of truth, you can identify the types of customer metrics and operational metrics that measure how successful you are at meeting your customers’ ultimate goals. Then you can focus your co-design activities on how to differentiate the experience, products, and services you offer to help customers reach those goals.

Identifying the metrics allows you to recognize:

- How the customer will be “grading” you

- How you grade yourself in helping the customer be successful

- How you can identify and measure business opportunities that can result from providing a great customer experience

PLANNING FOR RETIREMENT

Outcome-Based Scenarios

Planning for retirement, like acquiring a skill (the last scenario pattern we published) is an outcome-based scenario, where the goal isn’t necessarily tied into a date (although it may be). Another example might be a “losing weight” scenario.

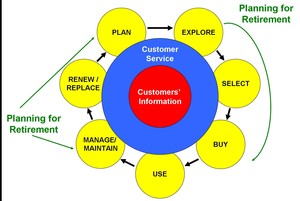

Looking through the “traditional” (at least for us) lens of the customer lifecycle, the planning for retirement touches on most of the lifecycle stages. It includes explore (looking for retirement/investment plans), select (choose the best one for me), buy (or invest), maintain (keep to the plan), and plan (figure out how you might need to tweak the plan to reach your goal). Ultimately, you will hit the use stage (actually retiring), but this is outside the scope of the scenario. (See Illustration 1.)

© 2009 Patricia Seybold Group

Illustration 1. Planning for retirement touches on most stages within the customer lifecycle, although it skips over the “use” stage. That comes into play when you actually retire.

A B2C Scenario

Unlike the scenarios we’ve looked at in the past, planning for retirement is exclusively a B2C scenario; the customers are individuals (or couples) planning for their personal lives. Although their jobs might play a role in achieving their desired outcome—e.g., setting up a 401k plan versus an individual retirement account (IRA), ultimately, retiring is something that individuals do outside of a business setting.

However, this Customer Scenario Pattern fits a variety of customers at different points in their lives. Later in this report we’ll take this pattern and apply it to four different demographics:

- Young couple (in their 20s) starting out together in life

- Relatively young professional (about 35) who wants to retire early and rich!

- New empty-nesters (approaching 50) who are ready to save for themselves rather than for the kids’ education

- Single woman approaching 60 who realizes that she hasn't thought about her retirement plan in 15 years and needs to see where she is and how she’s doing

In this report, we consider the organizations supporting these customers planning for retirement to be various types of financial institutions, including banks, investment firms, financial publications and information sources, and providers of financial planning tools.

Moments of Truth in Planning for Retirement

Although there are always variations on a theme (based on the specific situation and goals), there are four key moments of truth that show up in some manner in every retirement planning scenario...(more)

(Download the PDF to read the entire article.)

Sign in to download the full article

0 comments

Be the first one to comment.