The Mobile E-Wallet Customer Ecosystem

What Types of Players Need to Partner and What Do They Need to Do to Gain Customers’ Trust?

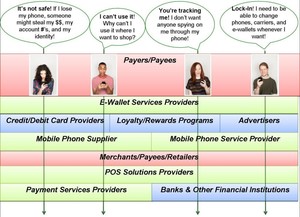

The mobile e-wallet landscape consists of a six-layered ecosystem of players, with e-wallet providers at the top, and payment settlement firms and financial institutions at the bottom. In order to gain traction in the U.S. market, the scores of players in each of these layers will need to cooperate and interoperate. Our suggestion: if all the players align around the four most customer-critical issues, it will accelerate the adoption of mobile e-wallets.

NETTING IT OUT

Mobile e-wallets are rolling out in the U.S. in late 2012, early 2013. We’ll all be encouraged to pay for things securely using our mobile phones. There’s a huge ecosystem gearing up to take advantage of the coming boom in convenient mobile payments, including e-wallet providers, credit/debit card companies, loyalty/rewards program providers, advertisers and the advertising networks that support them, mobile phone suppliers, mobile phone carriers and service providers, retailers, merchants and other businesses, POS solution providers, payment services providers, banks, and other financial institutions.

In early September 2012, we published an article describing the mobile e-wallet players we felt were likely to lead in the U.S. market: Amazon, Apple, Google, Isis (a consortium of three mobile telcos), Microsoft, and PayPal/eBay. Additional players are joining the fray almost daily. For example, MCX is a consortium of U.S.-based retailers that has announced its intention to deliver a cross-retailer e-wallet. Each of the major credit card players and most of the U.S. banks also have mobile e-wallet strategies.

In this article, we examine the state of the customer ecosystem that is emerging around mobile e-wallets in the U.S. We’ll provide an overview of the different types of players in the ecosystem. As more and more players continue to pile into this already-crowded ecosystem, you’ll want to be able to evaluate for yourself how well one each addresses consumers’ critical issues.

The two questions we’ll answer are:

- What customer-critical issues will impact consumers’ adoption of mobile e-wallets in the U.S.?

- What types of players are needed to create a viable mobile e-wallet ecosystem, and what will impact their ability to address customer-critical concerns?

Align the Mobile E-Wallet Customer Ecosystem around Consumers’ Issues

(Click on image to enlarge.)

2. The Mobile E-Wallet Customer Ecosystem. Here’s our view of the different types of players (and layers) in the mobile e-wallet ecosystem as viewed from the customers’ perspective. The customers are at the top. Their issues and concerns need to be addressed by all of the supporting players, from the mobile e-wallet players to the players in each of the subsequent layers.

WHAT ARE U.S. CONSUMERS’ CRITICAL ISSUES AROUND MOBILE E-WALLETS?

Mitigate the Showstoppers First!

Before you can build and evolve a customer ecosystem, you need to address the moments of truth that will stop customers from adopting and using your solutions. Once you identify the critical issues that are likely to keep customers from being successful in getting things done, you can mitigate those issues, either by transforming their fears into positive experiences and/or by understanding and meeting customers’ success criteria.

We believe that there are four customer-critical issues that need to be addressed proactively to make it easy for U.S. consumers to embrace mobile e-wallets and payment systems ...

Sign in to download the full article

0 comments

Be the first one to comment.